Stay Focused With a Targeted Innovation Process

To remain competitive and relevant, innovation has always been a high priority for businesses. But lately, the pandemic and its corresponding economic upheaval have forced organizations of all types to rethink their business models.

Who are your customers now, what do these customers need, and how will those needs change in the coming months — and even years?

Overwhelmed by the push for innovation, many leaders feel like they’re swimming upstream with no end in sight.

After decades of research, we know there is a universal process on how innovation happens — the targeted innovation process. Understanding the innovation process not only will help you focus, but it will also inspire you to lead your team as they develop valuable solutions for your organization and your clients.

4 Steps for Leading the Innovation Process

At CCL, we believe that no matter where you sit in the organization, you have a role to play in the innovation process.

And if you’re leading innovation, much of your work involves championing and connecting across and beyond your organization in order to gain traction for a proposed solution. Sometimes, the challenge is to get an initial solution out into the world and learn how to continuously develop and refine it. Other times, the challenge is to balance rigor and creativity.

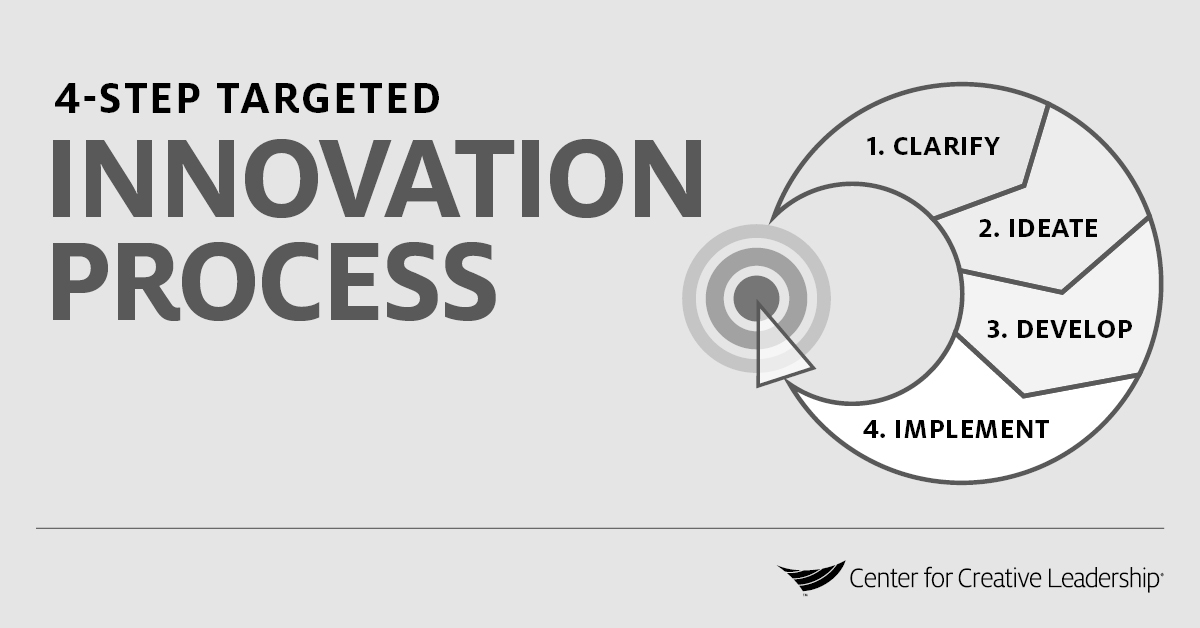

The innovation process has 4 stages:

- clarification,

- ideation,

- development, and

- implementation.

As an innovation leader, it’s important to note that all 4 phases of the innovation process need to happen. Part of the challenge for leaders is understanding when to spend more time on a phase and when to move ahead. And keep in mind that you may need to be flexible, going back and forth between the phases.

The 4-Step Targeted Innovation Process

The targeted innovation process helps you focus on innovation efforts and clarify your leadership role.

Step 1: Clarify.

The exploration process begins by framing the challenge in a way that encourages creative problem-solving. Then the people involved gather data, such as insights into potential clients. From dialog and discussion, information and perspectives emerge, allowing for new opportunities. Typically, your team will re-frame the challenge at least once during this stage. For more tips on how to define an innovation challenge, read 3 Practices That Will Help Drive Innovation in Your Organization.

Your leadership challenge: In the Clarify stage, it’s your job to develop a shared understanding of the situation and bring together many diverse perspectives. Not clarifying enough may lead to innovation that doesn’t resonate in the market because it doesn’t solve the right customer challenge. On the other hand, too much clarification could leave your project stuck in “analysis paralysis.”

Step 2: Ideate.

This is the process of generating, refining, and selecting ideas. As a leader, you want to create a collective sense of what is possible while avoiding the “feasibility trap.” Our research reveals when managers look at new ideas, they look for the most feasible ideas as their measure of desirability. Yet when customers look for new ideas, their measure of desirability is creativity. In fact, evidence suggests that customers want feasible ideas even less because they’re viewed as less creative.

Your leadership challenge: Hastily ideating might give you an idea, but maybe the idea is too obvious and you need to push your team for a more out-of-the-box concept. To avoid killing ideas and shutting down participation, encourage team members to stay open-minded. As you ideate, remember to keep your scope realistic and stay focused on the original challenge.

Step 3: Develop.

Leadership at this phase is about creating a well-refined concept through prototypes, experimenting and testing, and low-risk sharing. As ideas are refined, help your team identify additional stakeholders and develop collaborative relationships to introduce the idea and gain wide acceptance across the organization.

Your leadership challenge: Concepts, solutions, and plans need development and refining. After all, if you aren’t tweaking and adjusting the idea until the high-level concept works, you may find yourself redoing your concept later. On the other hand, if you keep developing an idea, it may never get to market.

Step 4: Implement.

The “doing” phase is about piloting and rolling out a solution. It’s also the learning and adapting phase. During product development or process improvement, help your team take in new information and adjust as needed.

Your leadership challenge: Leadership during this phase is about keeping the innovation on target and meeting the customer needs or the organizational challenge that initiated the innovation process. Before you roll out a solution, be sure you’ve thoroughly completed the previous 3 steps. Implementing too early can mean bringing a solution to market that nobody asked for (clarification), with an obvious idea (ideation), that isn’t thought through (development).

Access Our Webinar!

Watch our webinar, Building Resilience and Leadership in the Context of Crisis & Telework, and learn practical ways to enhance personal and team resilience and effectiveness during times of crisis.

Support The Innovation Process at Your Organization By Understanding Your Team

When you understand how the innovation process works, you can see what’s missing in your approach to leading innovation. Start to discern development needs for you and your team by asking these questions:

- What part of the process comes most easily to you?

- What needs to happen to bring others in the organization to embrace and champion the innovation?

- Do you need new skills or tools to work through the targeted innovation process?

- Does your managerial mindset need to expand or shift to effectively lead innovation?

- In what ways does the organizational culture support your team’s innovation, and what is getting in the way?

We’ve found that people tend to have preferences for one or more of these stages, which makes it twice as interesting for people tasked with leading innovation. Knowing your team’s preferences is essential for purpose-driven leadership and can reveal predictable dynamics, tensions, or blind spots as you work through the innovation process together.

Special Considerations Around the Innovation Process for Executives

Gerard Puccio researched these preferences and created the FourSight assessment, which we use in our custom leadership programs for innovation leadership. Research reveals that as we go up the corporate ladder, we find stronger ideation preferences — the tendency to generate lots of possibilities and think in original ways — and stronger implementation preferences — an inclination toward action and risk.

Together, these preferences form the profile of a “driver,” and organizations tend to have a bias toward the driver profile for senior-level leadership positions.

However, the clarification preference stays relatively stable across the corporate ladder, and the development preference stays relatively stable at low ends.

What does that mean? It means at higher levels of the organization, there might be a tendency to move from idea to implementation, without sufficient clarification on what problem you’re solving or without thinking through the solution. Knowing this, senior teams can and should pay more attention to these phases of the innovation process, and make sure team members who advocate for deeper clarification and better development are heard. This requires creating a work environment of safety and candor, taking particular care to encourage innovation instead of sabotaging it.

Ready to Take the Next Step?

Help your people learn more about the innovation process and how to drive it forward with a customized learning journey for your leaders at all levels using our research-backed modules. Available leadership topics include Leading Through Change & Disruption, Emotional Intelligence, Innovation Leadership, Learning Agility, Teamwork & Collaboration, and more.